Level III CFA Exam

Level III CFA Exam Quick Facts

- You must pass the Level II CFA exam before you can register for the Level III CFA exam.

- The Level III CFA exam fee is $700 for early registration and $1,000 for standard registration.

- Recommended study time for the Level III exam is at least 344 hours (the average study time of candidates that passed in 2019).

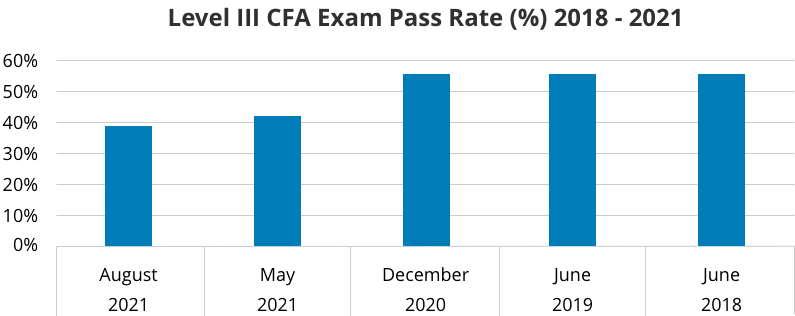

- The Level III CFA exam has the highest average pass rate out of the 3 exam levels (53%).

- The exam is 4 hours and 24 minutes long and consists of 8 to 10 vignette-supported essay sets in the morning session and 44 vignette-supported multiple-choice questions in the afternoon session.

- The Level III exam only tests 7 of the 10 CFA exam topic areas.

- Exam results for the Level III exam are available within approximately 90 days of the exam date or 10 weeks after the close of the exam window.

How to Study for the Level III CFA Exam

Follow this process to register and study for the Level III CFA exam.

1. Plan your Level III CFA exam date

Once you receive passing results for the Level II exam, schedule your Level III exam for at least 6 months after your Level II exam date. The Level III exam takes the longest to study for compared with the other 2 exam levels, so make sure you have enough time to study.

The Level III CFA exam is offered in May and August.

Learn more about the current CFA exam dates.

2. Register for the Level III CFA exam date

Use the same two steps to register for the Level III CFA exam as you used for the Level II CFA exam: Register for the exam and pay the CFA Level III exam fee ($700 for early registration or $1,000 for standard registration), then self-schedule your exam date and location via your CFA Program tile.

3. Schedule regular time to study

Create a consistent study schedule. Use what you learned from studying for the first two exams to perfect your study habits for this last exam. Just prepare to spend more time studying for Level III than any other exam level. Recommended study time for Level III is at least 344 hours (compared to 303 hours for Level I and 328 for Level II).

Learn more about UWorld CFA Level III Study Supplements and how they can help keep your study schedule on track.

4.Invest in course materials that help you pass the Level III CFA exam

Level III is often considered the hardest of the 3 exam levels because it introduces new open-ended answer formats and tests good judgment skills. Make sure you’re prepared by investing in a CFA review course that will help you understand the exam material and feel confident on exam day.

UWorld CFA review courses reliably prepare you for the Level III CFA exam with features like video lessons presented by expert instructors, practice exams, 30-45-minute bite-sized lessons, expert mentors, a Score Predictor, and more!

5. Expect to Pass the Level III CFA Exam

At this point, you’ve passed Level I and Level II of the CFA exam, so you should feel confident in your ability to pass Level III. Yes, it will still take a lot of hard work and sacrifice, but you know you’re up for the challenge.

Stick to your study plan, use UWorld CFA Program Exam study materials, pace yourself, and go into the Level III exam with a positive attitude and expecting to pass!

Level III CFA Exam Pass Rate

According to CFA Institute, the 10-year average pass rate for the Level III CFA exam is 53% while the overall CFA exam pass rate is 44%. It is often considered the hardest level of the CFA exam because it introduces constructed-response answer formats and tests decision-making ability.In August 2021, the Level III CFA exam pass rate was 39%–a historic low. This was likely due to COVID-19 test schedule disruptions, and pass rates are expected to recover. As with the other exams, if you make enough time to study and use the right exam prep service, you can be part of the percentage that passes.

Level III CFA Exam Weights and Reading Materials

Portfolio management and wealth planning comprises about 35-40% of the Level III CFA exam. An additional 15-20% of the exam will test fixed income, 10-15% will test equity investments, and ethics will account for 10-15% of the exam. Unlike the other 2 CFA exams, Level III only tests 7 of the 10 topic areas.According to CFA Institute, candidates who passed Level III in 2019 spent an average of 344 hours studying. Plan your study schedule after reviewing the CFA program curriculum and/or investing in a CFA exam prep service.

Level III CFA Exam Topic Weights:

| CFA Exam Topic Area |

Level III Topic Weight (%) |

|---|---|

| Ethical & Professional Standards | 10-15 |

| Quantitative Methods | 0 |

| Economics | 5-10 |

| Financial Statement Analysis | 0 |

| Corporate Issuers | 0 |

| Equity Investments | 10-15 |

| Fixed Income | 15-20 |

| Derivatives | 5-10 |

| Alternative Investments | 5-10 |

| Portfolio Management & Wealth Planning | 35-40 |

The Level III CFA Exam Passing Score

CFA Institute’s Board of Governors sets the minimum passing score (MPS) for the Level III exam based on recommendations from groups of CFA Charterholders who review the exam questions to establish how a minimally qualified candidate would perform. After taking the exam, you will receive an email with a result of “pass” or “did not pass” within approximately 90 days of taking your exam (or 10 weeks after the exam window has closed).

The Level III CFA Exam Structure

The Level III CFA exam is 4 hours and 24 minutes long, divided into two sessions, with an optional break offered between sessions. Both sessions use vignettes to deliver information to answer several questions. The first session of the Level III CFA exam consists of constructed-response and essay question formats and the second session consists of 8-11 vignette-supported multiple-choice items.The Level III exam curriculum focuses on fixed income investments along with portfolio management and wealth planning via questions that test analysis, synthesis, and evaluation skills.

Level I CFA Exam Format:

- Level III CFA exam, Session #1:

- 2 hours and 12 minutes

- 8-11 vignette-supported constructed-response item sets (answer formats: essay, numerical entry, and multiple-choice)

- Level III CFA exam, Session #2:

-

- 2 hours and 12 minutes

- 44 vignette-supported multiple-choice items with 4 or 6 questions

-

The Level III CFA Exam Curriculum

The Level III CFA exam curriculum only tests 7 of the 10 CFA exam topic areas. It heavily tests portfolio management and wealth planning with an additional focus on fixed income, equity investments, and ethics. Quantitative methods, financial statement analysis, and corporate issuers are not tested on the Level III exam.

Ethics and Professional Standards

Ethics and Professional Standards make up 10-15% of the Level III CFA exam. Candidates will be tested on their good judgment as it relates to ethics and professional standards in the investment industry.

Economics

Economics makes up 5-10% of the Level III CFA exam. This area tests the ability to synthesize concepts and evaluate situations related to developing capital market expectations for security selection and portfolio management.

Equity Investments

Equity Investments makes up 10-15% of the Level III CFA exam. Candidates will be tested on equity investments, security markets, indexes, and basic equity valuation models.

Fixed Income

Fixed Income makes up 15-20% of the Level III CFA exam. This section tests information related to fixed income securities, yield measures, risk factors, and valuation measurements and drivers.

Derivatives

Derivatives make up 5-10% of the Level III CFA exam. Candidates must demonstrate a high level of knowledge related to derivatives and derivative markets.

Alternative Investments

Alternative Investments make up 5-10% of the Level III CFA exam. The alternate investments tested in this area include hedge funds, private equity, real estate, commodities, and infrastructure.

Portfolio Management and Wealth Planning

Portfolio Management makes up 35-40% of the Level III CFA exam. Candidates must demonstrate their analysis, synthesis, and evaluation skills related to portfolio and risk management.

Taking the Level III CFA Exam

In the days leading up to the Level III CFA exam, plan the night before the exam and review what you’ll bring with you on exam day.As you go through final preparations make sure to check out our last-minute CFA exam tips.

The night before taking the Level III CFA exam

Hopefully, at this point, you have established a night-before-exam routine that includes healthy meals, relaxation, and plenty of sleep. We know a lot is riding on this exam but try to relax, perhaps reviewing any areas you want to reinforce. Avoid compromising your sleep with a late-night cram session.

What to bring into the CFA exam

Like the Level I and Level II exams, you are only allowed to bring a few approved personal items into the testing center (like a calculator, glasses, and your passport). For a refresher on this, see CFA Institute’s CFA Exam Personal Belongings Policy.

After You Take the Level III CFA Exam

After taking the Level III CFA exam, you just have to wait to receive your results. If you passed, congratulations! If you didn’t pass, plan to retake the exam at the next available window.

When do you get your scores back from the Level III CFA exam?

It will typically take longer to receive your CFA Level III results than it took to hear back on your other two exams. Your exam results will be delivered to you via email within approximately 90 days of your exam date or 10 weeks after the exam window has closed.

What if you don’t pass the Level III CFA exam?

If you don’t pass the Level III CFA exam, take a minute to mourn, give yourself grace, and register to retake it ASAP. Since you can only take one exam every 6 months, you will have to schedule your retake exam date at least 6 months after your most recent Level III exam date.

You will have to re-register to take the exam and pay another exam registration fee ($700 for early registration or $1,000 for standard registration). After that, self-schedule your retake exam. Both May and August 2022 exams must wait until February 2023 to retake.

Once your new exam is scheduled, resume studying immediately and use your performance report to craft your study plan.

What Happens When You Pass the Level III CFA exam?

Level III CFA Exam – Frequently Asked Questions (FAQs)

Here are quick answers to some frequently asked questions about the Level III CFA exam.

- That depends. Do you have at least 114 hours you can dedicate to studying each of those 3 months? Ideally, you would take 6 months to a year to study for the Level III CFA exam, but it’s possible to prepare in 3 months if you have the right study plan and study materials (i.e. study with UWorld’s CFA Program Exam Review).

- The Level III CFA exam will help you develop skills needed to qualify for certain jobs and promotions. It’s good to put on your resume in the interim between passing the CFA exam and becoming a CFA Charterholder.

- According to CFA Institute, the median Portfolio Manager base salary for a CFA Charterholder is $126,000 and total compensation is $177,000. Earning the CFA designation has the potential to increase your salary and listing each level of the CFA Exam you have passed on your resume can help impress employers. Earning the charter is a good time to negotiate a raise.

Related Articles

We use cookies to learn how you use our website and to ensure that you have the best possible experience.

By continuing to use our website, you are accepting the use of cookies.

Learn More