Is Finance a Good Career Path?

Your Career in Finance: Read Our Complete Guide Below

The finance industry is seeing unprecedented growth, in the U.S. and around the world. The industry extends far beyond Wall Street investment banks with professionals working in insurance, risk management, compliance, government, and a host of other areas.

If you’re interested in pursuing finance as a career path, then Wiley’s Ultimate Guide to a Career in Finance is for you!

Introduction to Our Career in Finance Guide

Finance covers a lot of ground and includes not only how money is managed but also the process of how funds are acquired.

It is commonly broken into three subcategories:

- Personal finance

- Corporate finance

- Public finance

Each of these categories requires a different skillset and mindset; however, the principles remain similar, and each role requires a familiarity and comfort with certain aspects of accounting.

The management of money requires sourcing money, which can be done personally or through a bank or through corporate funds, depending on the financing being handled. So, a career in finance requires not only understanding accounting principles, but also a clear understanding of the best tactics for raising and investing capital.

This finance guide is meant to provide you with a quick overview of:

- Potential careers in finance,

- Why you should choose a career in finance,

- Top career paths in finance, and

- How you can best position yourself to land a great job.

This guide also includes background information on educational programs, scholarships, and professional certifications.

Why Choose a Career in Finance?

A career in finance offers high pay and fast career placement after graduation. For example, the U.S. Bureau of Labor Statistics estimates the number of financial analyst jobs will grow by more than 12% through 2024, well above most categories

For personal finance advisors, the growth rate over the same period is nearly 30%, so there is no shortage of opportunity for people interested in finance as a career, especially in the United States. Finance jobs are growing at equal or faster rates in parts of Europe and Asia, outpacing most industries.

And for those with a solid background and/or professional credentials, job opportunities are especially good. Finance related positions are viewed as crucial organizational functions and are a profit center within corporations, not just for Wall Street investment houses.

List of Careers in Finance

Most people have heard about investment banking due to its renowned competitiveness and high pay, but not everyone realizes there is a wide range of finance careers that extend beyond supporting banks—and which still offer similarly impressive pay packages.

Some financial career paths require skills similar to accountants, but, even though accounting is certainly part of the job, there is clearly a focus on managing and investing as compared to auditing how money is used.

Common Investment Banking Careers in Finance Include:

- Financial Analyst

- Financial Consultant

- Portfolio Manager

- Investment Banker

- Financial Advisor

- Risk Manager

- Credit Analyst

- And Many Others

Each has its own career path in finance; however, in general it takes two years or more to move to a higher-level position, so substantial career progression requires long-term commitment.

Financial Analyst

All financial analysts analyze financial information; however, this position differs greatly by organization and industry.

A financial analyst within a corporation will:

- Analyze the financials of your company and its investments.

- Be looking for financial issues.

- Run the numbers for new projects.

- Do ad hoc reporting and analysis.

A financial analyst within an investment organization will:

- Likely be tasked with examining the financials of outside companies you’re looking to invest in, buy and sell. This requires a broad base of knowledge about different kinds of companies within industries as well as understanding how and why investments are made.

| Quick Facts: Financial Analysts | |

|---|---|

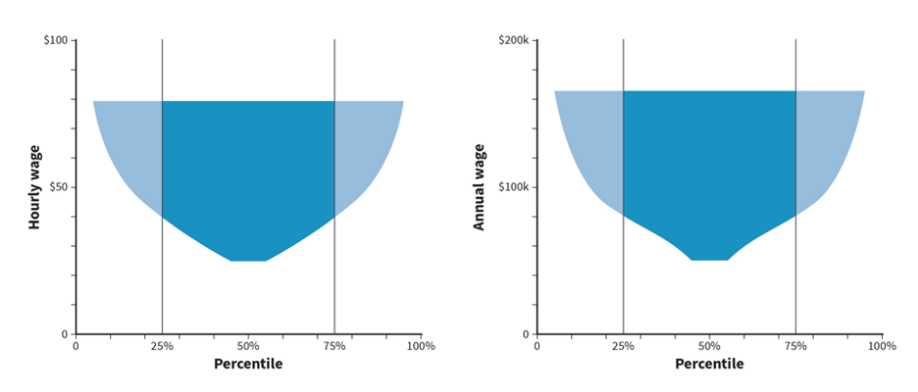

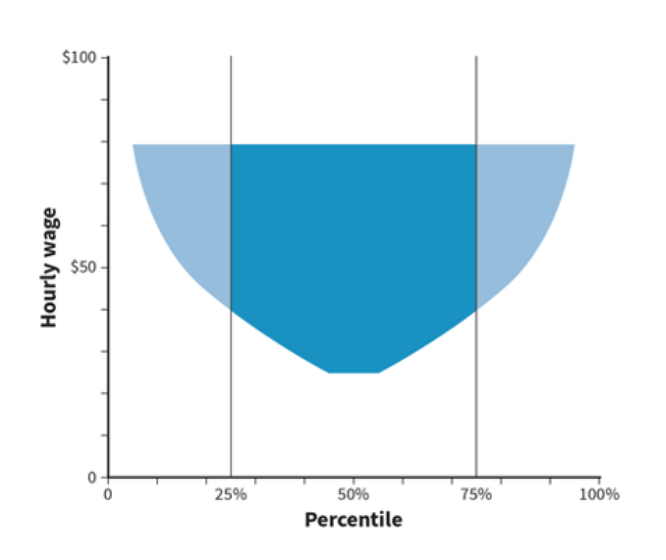

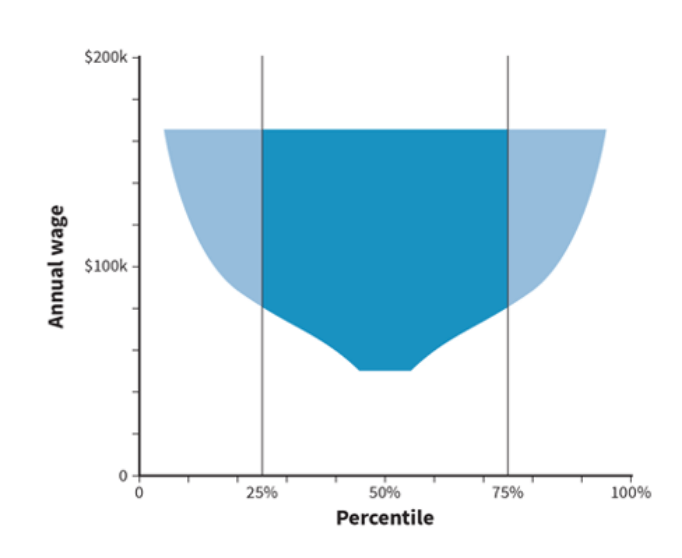

| 2020 Median Pay | $83,660 per year $40.22 per hour |

| Typical Entry-Level Education | Bachelor’s degree |

| Work Experience in a Related Occupation | None |

| On-the-job Training | None |

| Number of Jobs, 2020 | 492,100 |

| Job Outlook, 2020-30 | 6% (As fast as average) |

| Employment Change, 2020-30 | 31,300 |

Global Median Salaries:

| Hong Kong: $65,320 ($509,065 Hong Kong Dollars) |

| Singapore: $67,107 ($92,908 Singapore Dollars) |

| Sydney: $103,069 ($136,878 Australia Dollars) |

| New Delhi: $10,600 (682,544 Indian Rupees) |

| Frankfurt: $72,917 (65,130 Euro) |

| London: $78,939 (61,913 British Pound) |

Financial Consultant or Financial Advisor

A financial consultant or advisor generally works with companies or individuals concerning their financial situation. Most consultants or advisors focus on specific offerings to differentiate themselves from others. Potential consulting can be on topics that include taxes, investments, and insurance decisions.

Personal financial consultants or advisors work closely with clients to offer personalized financial advice and may direct the buying and selling of stocks and bonds on behalf of clients. Some financial advisors work for large banks but many work in smaller organizations.

If a financial consultant works within a consulting firm, he/she often focuses on the financial needs of a specific business or industry, such as hospitals.

Job Outlook (U.S. Only): Financial Advisor

| Quick Facts: Personal Financial Advisors | |

|---|---|

| 2020 Median Pay | $89,330 per year $42.95 per hour |

| Typical Entry-Level Education | Bachelor’s degree |

| Work Experience in a Related Occupation | None |

| On-the-job Training | Long-term on-the-job training |

| Number of Jobs, 2020 | 275,200 |

| Job Outlook, 2020-30 | 5% (Slower than average) |

| Employment Change, 2020-30 | 12,600 |

Global Median Salaries:

| Hong Kong: $53,443 ($416,508 Hong Kong Dollars) |

| Singapore: $54,905 ($76,015 Singapore Dollars) |

| Sydney: $84,329 ($111,991 Australia Dollars) |

| New Delhi: $8672.85 (558,445 Indian Rupees) |

| Frankfurt: $59,592 (53,228 Euro) |

| London: $64,586 (50,656 British Pound) |

Is Major Banks a Good Career Path?

Starting Your Finance Career Path

1. Get the right degree

You may think you don’t have to possess a degree to get a job in finance, but you’d be wrong. A bachelor’s degree is now the bare minimum requirement for almost any financial job. So, choose your degree and university carefully as some companies or banks limit their hiring to specific universities.

Make sure the college or university you choose has a solid business school and strong reputation in the finance industry. Also, if you want to move to a new location, ensure that your university has a large footprint that is recognized in the area you wish to find a job.

While science and engineering degrees are popular options, especially outside the U.S., know that you will need to supplement your undergrad degree with further finance-related education. Earning a Master of Business Administration (MBA) is the most common and direct route.

An MBA is also fast becoming a basic requirement to land a job on Wall Street.

2. Pursue a specialty

As you can see, finance is a wide-ranging industry and earning a degree targeted toward this area of business presents you with a lot of options. Graduates can find jobs in accounting departments, finance departments, education, sales, banking, financial advising—the list of career options is endless.

Most entities need someone with an analytical mind who can read financial data, interpret it and communicate findings and recommendations. During your education, you will have a few years to decide, but ensure you research the types of jobs you find most interesting.

You should eventually specialize in one facet of finance as specialization is the best strategy for a long and successful career. This is where earning one or more specialized credentials—such as the Charted Financial Analyst® (CFA), Charter Market Technician® (CMT) or Financial Risk Manager (FRM) designations—can truly help you to stand out and advance in your career.

Read more about these certifications in the table below.

3. Obtain a career in finance

After you’ve completed your post-secondary education, it’s now time to get a job. Remember it’s not just what you know, it’s also who you know—so put much effort into building and leveraging personal connections by going to conferences, job fairs, educational seminars and other networking events.

In order to continue to differentiate yourself, try to gain early career experience through internships. You may think it’s too early to start, but earning a professional credential can be a dramatic help in landing your first few jobs out of college.

It may seem like your learning is done when school is, but it’s only beginning. Those who succeed never stop learning.

Finance Certification and Licensure

Employers are now looking for job candidates who have additional credentials that demonstrate they have the prerequisite skills and knowledge necessary for a specialized job in finance. Every university is different in their teaching methods and the materials, so professional credentials are seen as a great way to level the playing field and ensure candidates have the basic knowledge to do the job on day one.

| Program | Advantages | Eligibility Requirements | Exam Difficulty Level |

|---|---|---|---|

| CFA® | Universal recognition and prestigious reputation

Broad-based foundational background in finance Enhances opportunities for higher paying career paths Low financial cost to attain |

Level 1 Exam (one of the three):

Bachelor’s degree or equivalent 4 years of professional work experience Cumulative 48 months of professional work experience and education Levels 2 and 3 Exam: Pass prior level of exam Pass all 3 exam levels 48 months of investment-related work experience in a full-time role |

Three levels of exams. Each level is considered extremely difficult.

Level 1 difficulty is primarily dependent on your educational and professional background, i.e., if you have a finance or statistics degree, you will have an easier time than someone with a philosophy degree. Exam pass rates are around 45%. Level 2 is considered the most difficult, as the content is discussed in much finer detail. Level 2 pass rate is around 40%. Level 3 is considered extremely difficult, although less so than Level 2. It includes short answer, multiple choice, and long answer questions. Level 3 pass rate is approximately 55%. |

| MBA | Universal recognition

Opportunities for networking Broad-based and transferable skill-set applicable beyond the finance industry Enhances opportunities for higher paying career paths Improvement of soft-skills such as self-confidence, communication, strategic thinking, and time-management |

Established by the university, generally includes the following requirement types:

Education, e.g., bachelor’s degree Undergraduate GPA, e.g., 3.6 Professional experience Standardized tests, e.g., GMAT/GRE |

Curriculum will cover broad array of subjects and the difficulty of each will depend on the candidate’s background and education.

Typically, the more difficult areas for MBA candidates are accounting, finance, economics, and practical projects / case studies. |

| FRM | Specialized certification that provides opportunities for advanced careers paths in financial risk management

Access to networking opportunities with other FRMs Certification with growing interest and credibility |

Parts I and II of the FRM exam

2 years of qualifying professional education |

Both exams are considered extremely difficult.

Part I covers the foundations of risk management, quantitative analysis, financial markets and products, and valuation and risk models. Part I pass rate is around 45% and requires an average of 275 hours of studying. Part II covers market risk, operational risk and residency, credit risk, liquidity and treasury risk, and investment risk. The pass rate for Part II is around 57% and is comparable in terms of study time requirements. |

| CFP | Associated with higher incomes than financial planners without the CFP certification

Enhanced technical expertise Improved credibility Applicable to various career paths, e.g., financial analyst, wealth management advisor, investment manager, portfolio manager |

Education: Bachelor’s degree, including specific finance coursework

Exam: 1 exam, 170 multiple choice questions over two 3-hour sessions Experience: 6,000 hours of financial planning experience / 4,000 hours of apprenticeship experience Ethics: Agreement to adhere to the ethical and professional standards for financial planning, i.e., to put the best interests of clients first |

This is a less difficult exam with a pass rate of around 63%. |

| CAIA | Global program

Provides broad knowledge and skill sets related to asset classes beyond standard equity and fixed income, including hedge funds, commodities, private equity, and structured finance products Provides access to networking opportunities through the CAIA association |

Level 1 and Level 2 exam | Both levels of the exam require roughly 200 hours of study.

The pass rate for the Level 1 is around 54% while the pass rate for Level 2 is 81%. |

| CIMA | Higher paying career opportunities than other investment management certifications, i.e., CFP, CFA®

Access to management of higher value portfolios Higher client confidence in investment management competence and capabilities Provides various career paths, including investment advisor, wealth advisor, retirement and pension plan consultant, and investment analyst Educational content provided by prestigious business schools, including University of Chicago Booth School of Business, University of Pennsylvania Wharton School, Yale School of Management, and Investment Management Research Centre of University of Technology, Sydney |

Experience: 3 years of financial services experience

Ethics: Background checks and disclosure of violations with the code of professional responsibility Education: Completion of executive education course from registered education providers Exam: Pass one exam |

Difficulty arises from the wide range of subjects included in the curriculum.

Exam is considered very difficult with overall pass rates between 60-70%. |

| CPA | Required certification for many advancement opportunities

Enhances opportunities for higher paying career paths in accounting and management Prepares candidates for careers in public accounting and managerial accounting, as well as tax planning and preparation Prestigious and nationally recognized certification (although state issued) Ability to practice independently Does not require work experience |

Vary state-to-state, but generally include:

Minimum Age: 18 years old Education: 150 credit hours, most states require a degree or credit hours to be in finance or accounting coursework Work Experience: 0-2 years of professional work experience, depending on the state Social Security Number and US Citizenship (only for few states) Completion of the uniform 4-part CPA exam administered by the AICPA |

Varying levels of difficulty across the 4 parts:

Auditing and Attestation Business Environment and Concepts Financial Accounting and Reporting Regulation Exam is considered to be difficult, as each exam part must be completed within 18 months and each requires extensive preparation. |

| CMT | Globally recognized

Specialized certification in investment management focused on technical analysis Differentiate profile as having a comprehensive technical skill set for technical financial analysis Accepted by FINRA as an alternative to the Series 86 examination |

3-level exam administered by the CMT Association

Agreement with the CMT Association Code of Ethics Membership in the CMT Association |

Levels 1 and 2 are multiple choice, and the first exam is a 4-hour essay.

It’s considered less difficult than the CFA® and CPA exams, as each level requires around 100 hours of study. |

| CMA | Provides basis for advancement into management level, appropriate for individuals aiming for a CFO position

Covers accounting and strategy concepts beyond the CPA certification Enhances earning potential, credibility, career advancement, and job security |

Education: Bachelor’s degree in relevant field

Experience: 2 years of professional experience in financial management or management accounting Exam: 2-part exam |

Both parts of the exam are considered highly difficult and more intensive than the CPA exam.

Explore some of the differences and nuances of the CMA vs CPA. It includes both multiple choice and essay questions. Part 1 covers financial reporting and planning. Pass rates for part 1 are around 35%, while part 2 is around 45%. Part 2 covers financial decision making. |

How to Choose Which Finance Certification Is Right for You

Which program or combination is right for you? Well, of course, only you can make that call.

The first step in making this decision is to clearly understand your career objectives. But keep in mind most careers take unexpected twist and turns, and your goals may change—and you will have to adapt accordingly.

With that said, we can dive into specifics. The MBA and CFA® offer the broadest and most comprehensive window into the world of finance. There is a great deal of content overlap, but the main trade off involves the cost/cost savings and flexibility of the CFA® process versus the benefits associated with obtaining a master’s degree from an accredited university.

The CPA is a very powerful and essential credential for those involved in auditing and certifying financial statements. It has other benefits as well, but the public accountancy certification is at its core.

The FRM covers risk management topics, which are as broad and diverse as the field of risk management itself. The CFP, CIMA and CMA are associated with money management and managerial techniques and analytics. Both subjects are broad in nature, so these programs offer a wide range of skills and insights.

Finally, the CMT and CAIA are more narrowly focused on technical analysis and alternative investments, respectively. These are valuable, but highly specific, credentials.

How you proceed is, of course, up to you, and it’s important that you choose carefully and wisely. But nonetheless, going down any of these paths with focus and determination will certainly expand your career and personal horizons regardless of what the future brings.

Related Articles

We use cookies to learn how you use our website and to ensure that you have the best possible experience.

By continuing to use our website, you are accepting the use of cookies.

Learn More