For Level I CFA exam candidates, macro and microeconomics can be tricky topics. That’s why the prerequisite readings are so important to cover and understand.

To help, UWorld CFA Program Exam Review is making available for free three key readings containing over 80+ pages of study text with examples, figures, and coverage of the original Learning Outcome Statements set by the CFA Institute.

In this free Study Guide, you’ll learn:

- Demand and Supply Analysis: Introduction

- Demand and Supply Analysis: Consumer Demand

- Demand and Supply Analysis: The Firm

Demand and Supply Analysis: Introduction

LOS a: Distinguish among types of markets.

Markets may be classified into the following types:

- Factor markets are markets for factors of production (e.g., land, labor, capital). In the factor market, firms purchase the services of factors of production (e.g., labor) from households and transform those services into intermediate and final goods and services.

- Goods markets are markets for the output produced by firms (e.g., legal and medical services) using the services of factors of production. In the goods market, households and firms act as buyers.

• Intermediate goods and services are used as inputs to produce other goods and services.• Final goods and services are goods in the final form purchased by households. - Capital markets are markets for long-term financial capital (e.g., debt and equity). Firms use capital markets to raise funds for investing in their businesses. Household savings are the primary source of these funds.

Generally speaking, market interactions are voluntary. Firms offer their products for sale if they believe that they will fetch a price that exceeds costs of production. Households purchase goods and services if they believe that the utility that they will derive from the good or service exceeds the payment required to obtain it. Therefore, whenever the perceived value of a good exceeds the cost of producing it, there is potential for a trade that would make both the buyer and the seller better off.

Demand and Supply Analysis: Consumer Demand

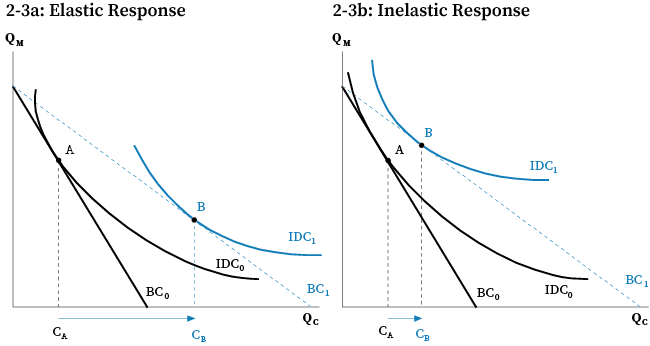

Figure 2-3: Elastic and Inelastic Responses to a Decrease in Price

Case 2: Changes in Price

Now we assume that the price of milk remains constant and that of chocolate decreases. A decrease in the price of chocolate results in an increase in the horizontal intercept (x‐intercept) of the budget constraint, while the vertical intercept (y‐intercept) remains the same. Figures 2-3a and 2-3b illustrate two types of responses that the consumer may have to this decrease in the price of chocolate.

-

- The quantity of chocolate consumed may increase by a relatively significant amount, which would imply that demand for chocolate is relatively elastic.

- The quantity of chocolate consumed may increase by a relatively small amount, which would imply that demand for chocolate is relatively inelastic.

Demand and Supply Analysis: The Firm

Objectives of the Firm

In this reading we assume that the primary objective of the firm is to maximize profits. Generally speaking, profits are calculated as the difference between total revenue and total costs. Total revenue is a function of the selling price and quantity sold, which are both determined by demand and supply in the market for the good produced by the firm. Costs are a function of the level of output, the efficiency of the firm’s production processes and resource prices (which depend on demand and supply in resource markets).

Types of Profit Measures

Accounting Profit

Accounting profit (also known as net profit, net income, and net earnings) equals revenue less all accounting (or explicit) costs. Accounting costs are payments to nonowner parties for goods and services supplied to the firm and do not necessarily require a cash outlay. Accounting profit (loss) = Total revenue − Total accounting costs.

Economic Profit and Normal Profit

Economic profit (also known as abnormal profit or supernormal profit) is calculated as revenue less all economic costs (economic costs include explicit and implicit costs). Alternatively, economic profit can be calculated as accounting profit less all implicit opportunity costs that are not included in total accounting costs.

Economic profit = Total revenue − Total economic costs

Economic profit = Total revenue − (Explicit costs + Implicit costs) Economic profit = Accounting profit − Total implicit opportunity costs

We use cookies to learn how you use our website and to ensure that you have the best possible experience.

By continuing to use our website, you are accepting the use of cookies.

Learn More