What is the CPA Evolution?

The National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA) have come together to analyze and update the ever-changing skills needed to be career ready in today’s—and tomorrow’s—accounting environment. Their goal with the evolution is to reexamine and improve the CPA licensure requirements to keep up with the competencies you’ll need to succeed in the field, ensuring more prepared candidates from day one.

What are these new career readiness skills?

Newly licensed CPAs need to have digital and data skills. More specifically, their jobs will demand that they:

- Identify structured and unstructured data from key business processes.

- Understand attributes of data repositories.

- Understand capabilities of tools supporting data extraction and analysis.

- Recognize legal, ethical, business, and intellectual property considerations around data governance.

- Exercise professional skepticism and judgment analyzing data and information to be used as evidence. For example, is it reliable, or does it corroborate or contradict management’s assertions?

How will these job skills be reflected in the CPA exam?

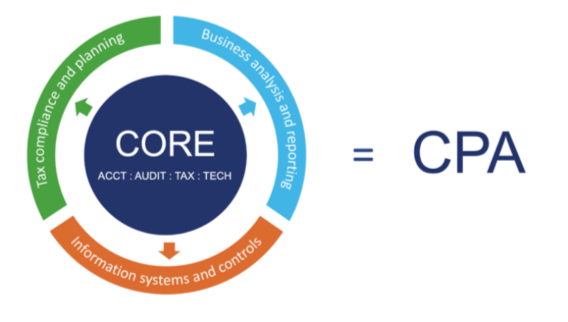

These evolving skill requirements are exactly why the CPA exam is changing—and how you’ll need to prepare for it. Overall, there will be a continued and increased emphasis on analytical skills and problem solving. The new model is a core PLUS disciplines licensure model.

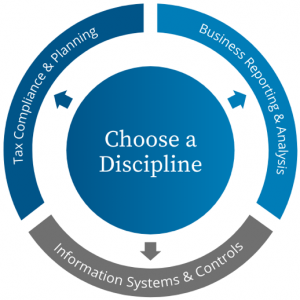

The model starts with a deep and strong core in accounting, auditing, tax and technology that all candidates will be required to complete. Then, each candidate will choose a discipline in which to demonstrate deeper skills and knowledge. Regardless of chosen discipline, this model leads to full CPA licensure, with rights and privileges consistent with any other CPA. A discipline selected for testing does not mean the CPA is limited to that practice area.

This model:

- Enhances public protection by producing candidates who have the deep knowledge necessary to perform high-quality work, meeting the needs of organizations, firms and the public

- Is responsive to feedback, as it builds accounting, auditing, tax and technology knowledge requirements into a robust common core

- Reflects the realities of practice, requiring deeper proven knowledge in one of three disciplines that are pillars of the profession

- Is adaptive and flexible, helping to future-proof the CPA as the profession continues to evolve

- Results in one CPA license

The new CPA exam will have 3 mandatory core sections (Accounting and Attestation (AUD), Financial Accounting and Reporting (FAR), Tax & Regulation (REG)) and 3 optional discipline sections (Business Analysis and Reporting (BAR), Information Systems and Controls (ISC) and Tax Compliance and Planning (TCP)).Each candidate must take the 3 mandatory core sections plus 1 of the optional discipline sections of their choice.

Question: What will be tested on the new exam?

Answer: Even though the names of the core sections have remained the same, the exams will NOT be the same. The good news is that much of what you are currently studying remains testable in the exam. They have taken the current content requirements and moved them around into the now six different areas. In the Core areas, they have tried to focus on the minimum skill and knowledge levels. More complex or specialized topics have been moved to the Discipline areas. They have also deleted some content, e.g., Business Law, and added some content.

What have they added? The new model contains a much heavier focus on data analytics and something they are calling digital acumen. In general terms, digital acumen means the ability to recognize, learn, and utilize changing technology in the performance of professional responsibilities.

Question: I’d like to understand how the disciplines will play out and how does a candidate opt for them?

Answer: When you sign up to take the discipline section, you will be signing up to take the area that you have selected. They are expecting candidates to select the discipline area that most appeals to them. They have offered suggestions as to the types of candidates who might be interested in each part.

When will these exam changes go into effect?

The AICPA Governing Council and the NASBA Board of Directors are moving forward with implementing the core + discipline licensure model with a goal date of January 1, 2024, so please keep this date in mind as you prepare your testing path and dates.

To learn more about the CPA Evolution and get answers to the most commonly asked questions, visit https://www.evolutionofcpa.org/#students/.

2024 CPA Exam Transition Policy

NASBA recently announced the 2024 CPA Exam Transition Policy. For those of you continuing your CPA Exam journey into 2024 and beyond, this much-anticipated transition policy is important news. It lays out how CPA Exam sections passed under the current CPA Exam map to credit under the 2024 CPA Exam.

Question: What if I partially pass the exam by the end of 2023 – will I lose the previous subject credits?

Answer: You will not lose any credits!

Under these circumstances, the transition policy will come into play. It is pretty straightforward. There is a one-to-one relationship for AUD, FAR, and REG – if you have passed those, you get credit for the new ones. If you have passed BEC, you get credit for one of the disciplines, BAR, ISC, or TCP. The reverse is also true – if you haven’t taken and passed AUD, FAR or REG, you will need to take the new versions of those. If you haven’t taken and passed BEC, you will need to select one of the disciplines.

Question: What do I do if I have passed 3 sections prior to January 1, 2024, and I must sit for my last section in 2024? How will that work?

Answer: You will sign up for your last section in the same manner as you have signed up for the previous parts. Then, if you need AUD, FAR, or REG, you will sign up for the new version. If you need BEC, you will be able to select from the three discipline choices – BAR, ISC, or TCP. This last section will need to be passed within the 18-month period that began when you passed your first section.

Question: Do I still have 18 months to pass?

Answer: Yes. There are no changes to the 18-month policy. You will need to pass all 4 within an 18-month period that begins when you pass your first section.

Get answers to all of your CPA Evolution questions

We’ve had numerous questions about the CPA Evolution and what it means for those of you taking the exam into 2024. Watch our leading CPA Exam expert, Dr. Jeannie Yamamura, as she addresses more of your questions and provides expert advice in this 15-minute Q&A Session.

We are here for you

We want to hear from you! Do you anticipate the CPA Evolution impacting you and what questions do you have? Share your CPA Evolution questions with us here and we will address them in future Q&A sessions with our experts.

How Wiley Is Keeping Up With the CPA Evolution

Wiley is monitoring all new information released by the AICPA to determine exactly how the CPA Evolution will affect the CPA exam.

We have assembled a task force of lecturers and subject matter experts on the AICPA Evolution task force to chart how CPA exam content will be moved (either to the core material or within the three discipline areas), added, or trimmed. At this time, the AICPA has released a big-picture model of the CPA Evolution changes, as well as more specific changes in the CPA Evolution Model Curriculum. The AICPA expects to publish an exposure draft of the new Exam blueprint in mid- 2022, followed by a final blueprint in early 2023. Wiley will make updates to courses and materials as this information is released.

While there is a lot of change happening within the accounting industry and to the CPA exam, Wiley is keeping tabs on it all and will make sure you are prepared to succeed on the exam. With our Unlimited Access Until You Pass Guarantee, you’ll receive access to the most up-to-date materials until you’re over the finish line.

Taking the CPA exam in 2022? In 2022 there are changes to all four sections of the exam, with significant pronouncements changes occurring in AUD. Take a closer look at these changes in our Summary of January 2022 Content Changes.

Sign Up For a Free CPA Practice Exam

Wiley’s Free CPA Practice Exam is helpful for both individuals considering taking the CPA exam and those currently studying for the exam. It helps you understand the strengths you already have and where you can improve.