What tasks and tools define the accounting industry? It depends on who you ask. While those on the outside may think the field involves little more than bookkeeping and tax preparation, like utilizing tools such as Excel© and QuickBooks, accounting professionals and other industry insiders know that accounting is indeed an evolving field.

According to the Institute of Management Accountants (IMA ®), as reported by Accounting Today, accountants are increasingly relying on big data. The emerging importance of big data systems is already being integrated into accountant training in the form of a new certificate and testing on the updated Certified Management Accountant (CMA) exam. Changing norms around data storage, governance, and use are also being addressed in the Certified Public Accountant (CPA) exam, with expanded coverage of data and data analytics.

However, it’s not just CMAs and CPAs who need to know about new big data practices. For those already in the industry, they can elect to take CPE courses covering new topics in big data to ensure they stay up to date on the skills and knowledge they need to succeed.

Beyond Acknowledgement—Seeing The Opportunities

Saying that certifying bodies will test applicants on their knowledge of big data in accounting is important, but we can only understand the importance of this shift by looking at the types of opportunities and practical changes big data implementation is driving. The issue at hand is not the emergence of these tools, but why they matter to accountants.

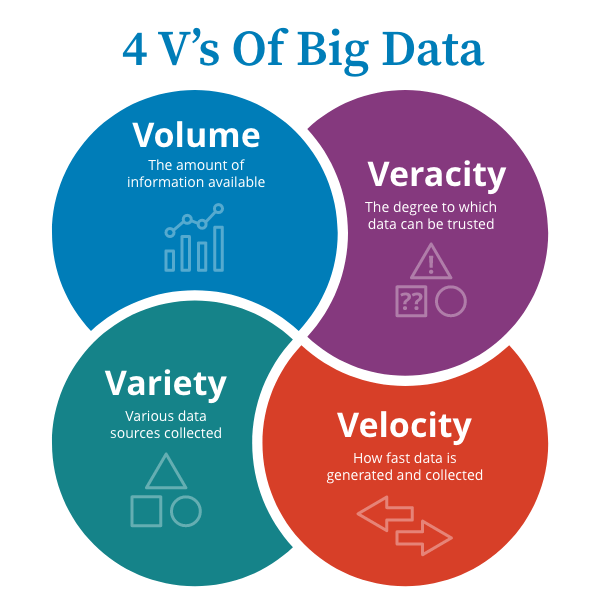

There are several ways of thinking about this information, starting with how we think about big data and then moving on to how the industry uses it. Practically speaking, big data helps professionals regardless of the industry by multiplying the amount of information available (volume), increasing the trustworthiness of the data (veracity), expanding the number of sources data is collected from (variety), and speeding up how fast data is generated and collected (velocity).

Professionals call these the four Vs, and data characterized by these traits, as well as systems that can handle this type of data, are increasingly available across industries, including accountants.

As far as how the accounting industry uses big data, applications vary depending on the type of accounting work. Some of the vital ways that accountants have been putting big data to work include:

Access to large data sets makes it much easier for accounting firms to identify potential problems in transactions or account balances, as well as making it simpler to spot trends. And, conversely, big data makes it much easier to identify outliers and determine whether that outlier is an error or an opportunity.

Accounting is a diverse industry, and it includes a variety of analytics careers that stand to benefit from the growth of big data systems. For example, analytics experts can use big data tools to identify system inefficiencies that are holding back profits, allowing them to recommend ways of streamlining or restructuring those systems. Accountants who are already using big data tools to advise clients have seen them reallocate investments, reorganize supply chains, and much more in response to these insights.

Many accountants work with clients to help them develop business strategies, often starting with certain pieces of fixed information and then comparing variables. By using big data tools, though, we can use a combination of past experience and predictive analytics to compare possible outcomes. This practice is related to the use of big data in revenue generation, but it looks at future business possibilities instead of current operations. Put another way, it’s where simple big data meets machine learning.

Risk is a major issue in all industries, and it is one that accountants are increasingly asked to consider when helping businesses work on financial plans. Big data is a powerful tool for risk assessment because of its ability to factor in a variety of predictive elements alongside historic data.

New Collaborations Emerge

While big data may allow accountants to offer new services, part of thinking through the industry’s transformation is acknowledging that most of us will not be able to become big data experts overnight—and especially in smaller firms, such skills may be hard to come by for years. That’s not as serious of an issue as it may seem, though, because such shortcomings are really doorways to new collaborations.

As big data has become more important to accounting and finance, some larger accounting firms have started bringing in data science experts and teaching them accounting basics. We can also expect to see substantial growth in big data services targeting accountants. Finally, younger professionals who are more data and technology savvy will be a critical resource, acting as co-mentors with accounting professionals to exchange skills and build internal capacity.

It’s not just that accounting firms will partner with new technology companies or professionals to make use of big data that makes this change significant. It’s also important to acknowledge that these new systems will expand the role accountants play in their clients’ operations. If we look at the ways accountants are expected to apply big data above, it’s clear that accountants are going to have to pivot from being data managers to being active strategists. Instead of providing businesses with raw data or the basic statistical analysis of information, they’re going to be sources of advice. That’s a big shift, and it is one that will require us to change how we think about our roles, not just how we perform them.

Stay Open And Get Ready

Any time we talk about trends, we run the risk of seeing an overly reactive response, which is to say those who prioritize older ways of doing things may double down on such practices. As accountants, we can’t afford to do that. All accountants and firms, no matter their size, need to be open to the influence of big data on the industry, or else they risk falling behind. The question, then, is how will you keep up?

If you’re interested in learning more about how big data is changing the accounting industry, we’re here to help. Learn more about our educational programs and how we’re preparing the next generation of accountants. Though big data tools may seem supplementary to the core work of accountants, they’ll soon be indispensable. So don’t wait to ensure you’re ready to tackle and implement big data.