CFA Level II Practice Questions

CFA Level II Practice Questions Quick Facts

- The Level II CFA exam format consists of item sets or mini-cases rather than the more traditional multiple-choice questions from Level I.

- There are a total of 88 multiple-choice questions with item sets of vignettes.

- Each vignette consists of 4-6 questions.

- Wiley offers a variety of practice questions and mock exams with question banks designed to help candidates maximize each study session.

Can You Pass These Level II CFA Practice Exam Question Examples

Level II CFA Exam Question Types

Before you begin to study for the Level II exam, it’s vital to understand the exam format and the question types. Unlike CFA Level I, where you were asked to answer straightforward multiple-choice questions, Level II adds a layer of complexity in the form of vignette-style questions. Each item set consists of a vignette with either 4 or 6 multiple-choice questions.

The questions in the item set must be answered based on the vignette information, which you’ll need to refer to before answering. This is much more difficult than the Level I exam, as it forces CFA candidates to have a deeper understanding of the topic areas like Corporate Finance, Fixed Income, Derivatives, Financial Reporting and Analysis (FRA), and Ethics and how to apply them to real-life situations.

Be prepared for all types of exam questions with our CFA Level II Test Bank.

Level II Exhibit Example

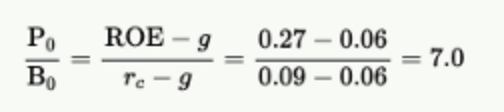

Riback believes the company can earn a 27.0 percent return on ROE and grow at a 6.0 percent rate over the long term. She has further estimated that the required return for equity is 9.0 percent.

Three W incurred a large amount of debt in 2008 to repurchase its shares. Three W also reacquired more equity shares than it issued in 2011 and 2012. Selected financial information for Three W appears in Exhibit 1, with additional data in Exhibit 2.

Level II Exhibit Example

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

|

|---|---|---|---|---|---|---|

| Sales | $29,904 | $29,611 | $29,662 | $23,123 | $25,269 | $24,462 |

| Earnings to common shareholders | 4,719 | 2,801 | 4,257 | 3,193 | 3,460 | 4,096 |

| Ending book value of common equity | 18,040 | 15,862 | 16,017 | 13,302 | 10,304 | 12,072 |

Exhibit 2 – Three W: Additional Data (Share data in millions of shares)

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

|

|---|---|---|---|---|---|---|

| Debt-to-total capital | 25% | 25% | 25% | 30% | 39% | 29% |

| Stock price | $92.85 | $81.73 | $86.30 | $82.67 | $57.54 | $84.32 |

| Common shares outstanding (period end) | 687.1 | 695.0 | 712.0 | 710.6 | 693.5 | 709.2 |

| Weighted average common shares | 693.9 | 708.5 | 713.7 | 700.5 | 699.2 | 718.3 |

| outstanding (WACSO) – basic WACSO – diluted | 703.3 | 719.0 | 725.5 | 706.7 | 707.2 | 732.0 |

Riback discusses her analysis with her supervisor, Bob Montgomery, who will present the case for or against inclusion in the portfolio to the firm’s investment committee. During her meeting with Montgomery, Riback discloses that she calculated price-to-earnings and price-to-sales (P/S) ratios for Three W but prefers the price-to-book value (P/BV) multiple for the comparison to the benchmark. She justifies her decision with the following three reasons:

- Reason 1: P/BV is more stable than price multiples that use sales or earnings.

- Reason 2: P/BV is meaningful when a firm’s earnings are zero or negative.

- Reason 3: P/BV is better at reflecting the market’s perception of the firm’s underlying return for long-term investors.

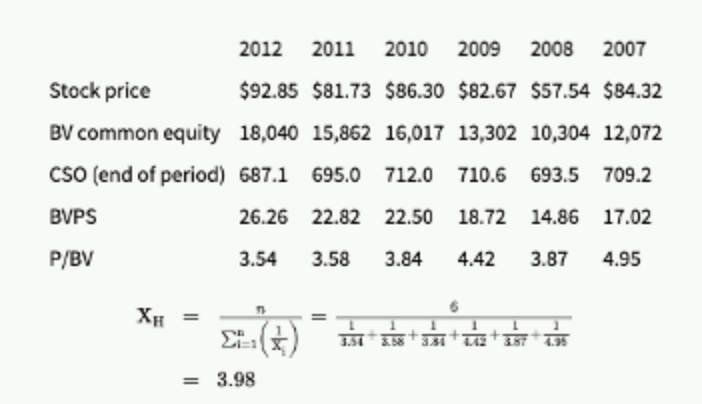

Montgomery suggests that Riback compare Three W’s current P/BV against its historical P/BV calculated using the harmonic mean, simple average, and median. Montgomery also suggests that Riback calculate the fair value (justified) for Three W’s P/BV based on the forecast fundamentals method.

Question 1

Riback’s use of the P/BV multiple is best supported by:

- Reason 1

- Reason 2

- Reason 3

Question 2

How much different is Three W’s 2012 P/BV relative to its harmonic mean for 2007 to 2012?

- Less by 0.44

- Greater by 023

- Greater by 0.37

Question 3

Based on Three W’s justified P/BV calculated by the forecast fundamentals method using ROE from 2007 to 2012, its current P/BV could best be described as:

- Overvalued

- Undervalued

- Fairly valued

Answer Explanations

1. C) Reason 3.

Although growth investors will be reluctant to purchase a cyclical company for short-term earnings in a slowly recovering economy, a value investor might be more inclined to purchase the firm based on potential returns on assets, assuming stable liabilities.

Studies have shown that low P/BV more closely relates to potential returns than P/E ratios. Reason 1 will tend to be true when the subject company has not had substantial shifts in debt-to-total capital, including share issuance, repurchase, and dilution. Reason 2 does not apply because the firm has not experienced zero or negative earnings.

2. A) Less by 0.44.

Price-to-book value over the period is:

The 2012 P/BV is less than the harmonic mean by 0.44 (3.54 – 3.98). Note also that the harmonic mean will always be less than the arithmetic mean unless all observations are equal.

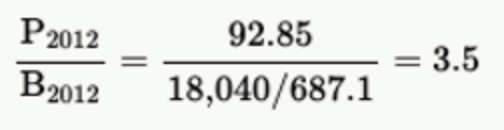

3. B) undervalued.

The justified P/BV is calculated as follows:

Three W’s shares are undervalued based on the outcome that Three W’s justified P/BV based on the forecast fundamentals method is greater than the company’s current (2012) P/BV of 3.5. The 3.5 is calculated as follows:

CFA Level II Ethics Practice Questions

CFA Level II Ethics Practice Question Vignette

The CFA Level II exam consists of vignettes (case description to which the questions refer) covering 88 multiple-choice questions in total. Test your knowledge on the Ethics portion of the exam in the below Level II exhibit questions.

CFA Level II Exhibit

King Asset Management (KAM) is a small investment company, which has never had a formal compliance policy. Rhonda Deitz is the firm’s newly-appointed compliance officer. The firm has adopted the CFA Institute Standards of Professional Conduct as the basis for its compliance program. Dietz met with KAM’s executive team to discuss compliance issues. She opened the meeting by saying, “The first steps we need to take are to:

- draft and disseminate a written code of ethics to all our employees;

- hire an in-house lawyer to address any ethical issues and answer questions;

- build a written compliance manual to document laws, rules, and regulations.”

Noting that KAM has a few high-profile asset managers on its team making public appearances on radio and television, Dietz suggests that the firm also adopts the CFA Research Objectivity Standards.

Craig Hanson, portfolio manager, points out that the Standards of Professional Conduct and Research Objectivity Standards are substitutes for one another stating, “We should either adopt one or the other, not both.”

Matt Reynolds added to the conversation by saying, “The ROS are most appropriate for a sell-side firm. As a buy-side firm, we would be better served incorporating a public appearance policy into our program.”

Dietz ends the meeting but stopped Barbara Jenkins, the firm’s human resource manager, on the way out. She asked her to make some recommendations about hiring procedures and documenting employee activities. Jenkins agreed to send her an email with some initial suggestions.

Question 1

Which of the initial steps that Dietz listed at the start of her meeting with the firm’s executives is least consistent with the required compliance or recommended procedures with respect to Professionalism?

- Step 1

- Step 2

- Step 3

Question 2

Which employee’s statement is least consistent with the CFA Institute Research Objectivity Standards?

- Dietz’s

- Hanson’s

- Reynold’s

Question 3

According to the Standards of Professional Conduct required compliance and recommended procedures, which of the following suggestions sent from Jenkins would be least appropriate?

- Require each employee to endorse the firm’s written code of ethics by signature.

- Suspend participants in personal bankruptcy or acts of civil disobedience.

- Perform pre-hire background checks and require character referrals.

Level II CFA Exam Answers

- Step 2

- Hanson’s

- Suspend participants in personal bankruptcy or acts of civil disobedience.

Level 2 CFA Answer Explanations

Question 1

Step 2 is the least consistent. The recommended procedures of Standard I(A) state that firms should develop and adopt a written code of ethics, which should be disseminated to all employees. It also suggests the firm’s document currently applicable rules and regulations in a written compliance manual accessible to all employees. While it does suggest that employees seek legal counsel to resolve questionable issues, it does not require that the firm hires in-house lawyers for this purpose.

Question 2

The Research Objectivity Standards are meant to complement, not replace, the Standards of Professional Conduct.

Question 3

The standards do not penalize members for legitimate personal bankruptcies or for exercising their social or political beliefs through protest. Standard I(D) does recommend the endorsement of the firm’s adopted code of ethics by all employees. It also suggests appropriate due diligence in ensuring the firm only hires employees with high ethical character.

Master CFA Practice Questions

CFA Level II Practice Questions – Frequently Asked Questions (FAQs)

- You can practice for the CFA Level II exam by using Wiley’s prep course filled with practice questions and mock exams to prepare you for exam day.

- Practice questions are often harder than the questions you’ll encounter on the actual exam to better prepare you for the CFA exam.

- You can find CFA practice questions in many locations, but few are designed to resemble the exam questions as well as Wiley’s study materials.

- CFA Institute practice questions are a helpful start to your Level II studies but will only provide a foundation to work from and are not enough on their own.

We use cookies to learn how you use our website and to ensure that you have the best possible experience.

By continuing to use our website, you are accepting the use of cookies.

Learn More