How Could the CPA Evolution Impact Your Firm?

Accounting firms are highly anticipating the CPA Evolution, seeing as 56% currently face challenges finding candidates with the right soft skills, and 45% face challenges finding candidates with the right job-specific skills.

However, since the exam will test students on skills their university may have failed to offer as part of the new Model Curriculum, there could be negative effects immediately following the release of the new exam.

New Exam Topics Could Result in a Longer Certification Process

As part of the CPA Evolution process, AICPA and NASBA reached out to over 1,200 university accounting department chairs across the country to ask them if their accounting programs are teaching topics such as data analytics, IT audit, cybersecurity, and more. They received 317 responses from small to large accounting programs throughout the United States.

The findings in this report show us that there are major gaps in accounting education today in several crucial areas for accounting students. For example, we learned that while around 64% of accounting programs are teaching data analytics, fewer than half of accounting programs teach emerging topics such as IT governance and cybersecurity. Where these topics are being covered, they are often being covered in only a couple of class sessions.

Since the new CPA exam will cover many of these emerging topics, firms could see their new hires taking longer to pass either due to longer study times or multiple attempts to pass.

What Skills Are Reflected in the New CPA Exam?

Firms need newly licensed CPAs (nlCPAs) who have digital and data skills. More specifically, this new exam will test candidates on their abilities to:

- Identify structured and unstructured data from key business processes.

- Understand attributes of data repositories.

- Understand capabilities of tools supporting data extraction and analysis.

- Recognize legal, ethical, business, and intellectual property considerations around data governance.

- Exercise professional skepticism and judgment by analyzing data and information to be used as evidence.

These evolving skill requirements are exactly why the CPA exam is changing—and how CPA candidates need to prepare for it. Overall, it’s important to know there will be a continued and increased emphasis on analytical skills and problem solving.

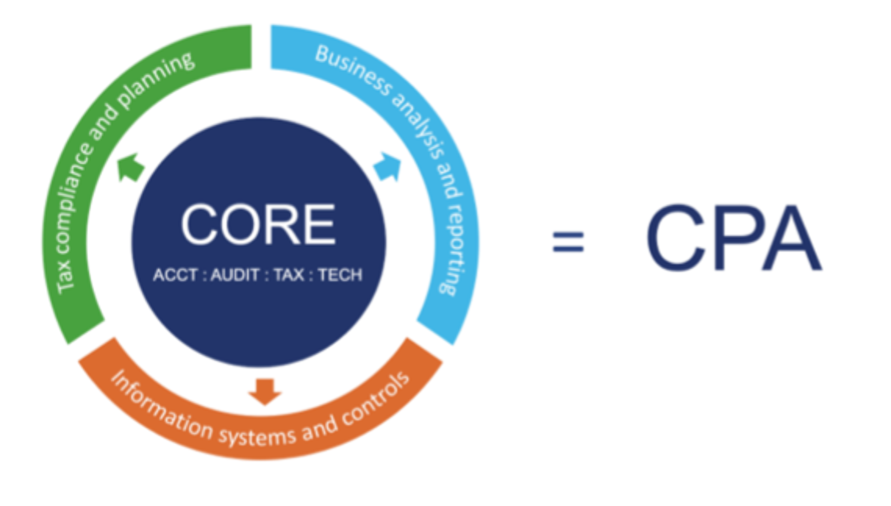

The new model is a Core PLUS disciplines licensure model that starts with a deep and strong core in accounting, auditing, tax and technology that all candidates will be required to complete. Then, each candidate will choose a discipline in which to demonstrate deeper skills and knowledge. Regardless of chosen discipline, this model leads to full CPA licensure, with rights and privileges consistent with any other CPA. A discipline selected for testing does not mean the CPA is limited to that practice area.

This model:

- Enhances public protection by producing candidates who have the deep knowledge necessary to perform high-quality work, meeting the needs of organizations, firms, and the public

- Is responsive to feedback, as it builds accounting, auditing, tax, and technology knowledge requirements into a robust common core

- Reflects the realities of practice, requiring deeper proven knowledge in one of three disciplines that are pillars of the profession

- Is adaptive and flexible, helping to future-proof the CPA as the profession continues to evolve

- Results in one CPA license

The new CPA exam will have 3 mandatory sections and 3 optional sections.

Mandatory Sections

- Accounting

- Auditing

- Tax & Technology

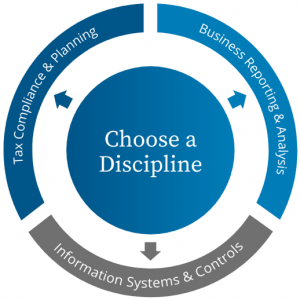

Optional Sections

- Tax Compliance & Planning

- Business Reporting & Analysis

- Information Systems & Controls

Each candidate will take the 3 mandatory sections plus 1 of the optional sections of their choosing.

How Wiley Is Keeping up With the CPA Evolution

Wiley is monitoring all new information released by the AICPA to determine exactly how the CPA Evolution will affect the CPA exam, accounting industry, and your firm.

We’ve assembled a team of lecturers and subject matter experts to chart how CPA exam content will be moved (either to the core material or within the three discipline areas), added, or trimmed.

As of right now, the AICPA has only released a big-picture model of the CPA Evolution changes and will release more specific changes in the Model Curriculum and new Blueprints in the coming months. The Model Curriculum was released in June 2021, the Blueprints will be released in the beginning of 2023, and the new Uniform CPA Exam will launch in 2024. Wiley will make updates to courses and materials as this information is released, and we offer many education solutions to get your current employees up to date on their skills in the interim.

While there is a lot of change happening within the accounting industry and to the CPA exam, Wiley is staying informed on all changes and will make sure you have the tools needed to train your employees. That includes CPA exam prep that helps your associates study efficiently and pass faster.